Fuel data

UK economy

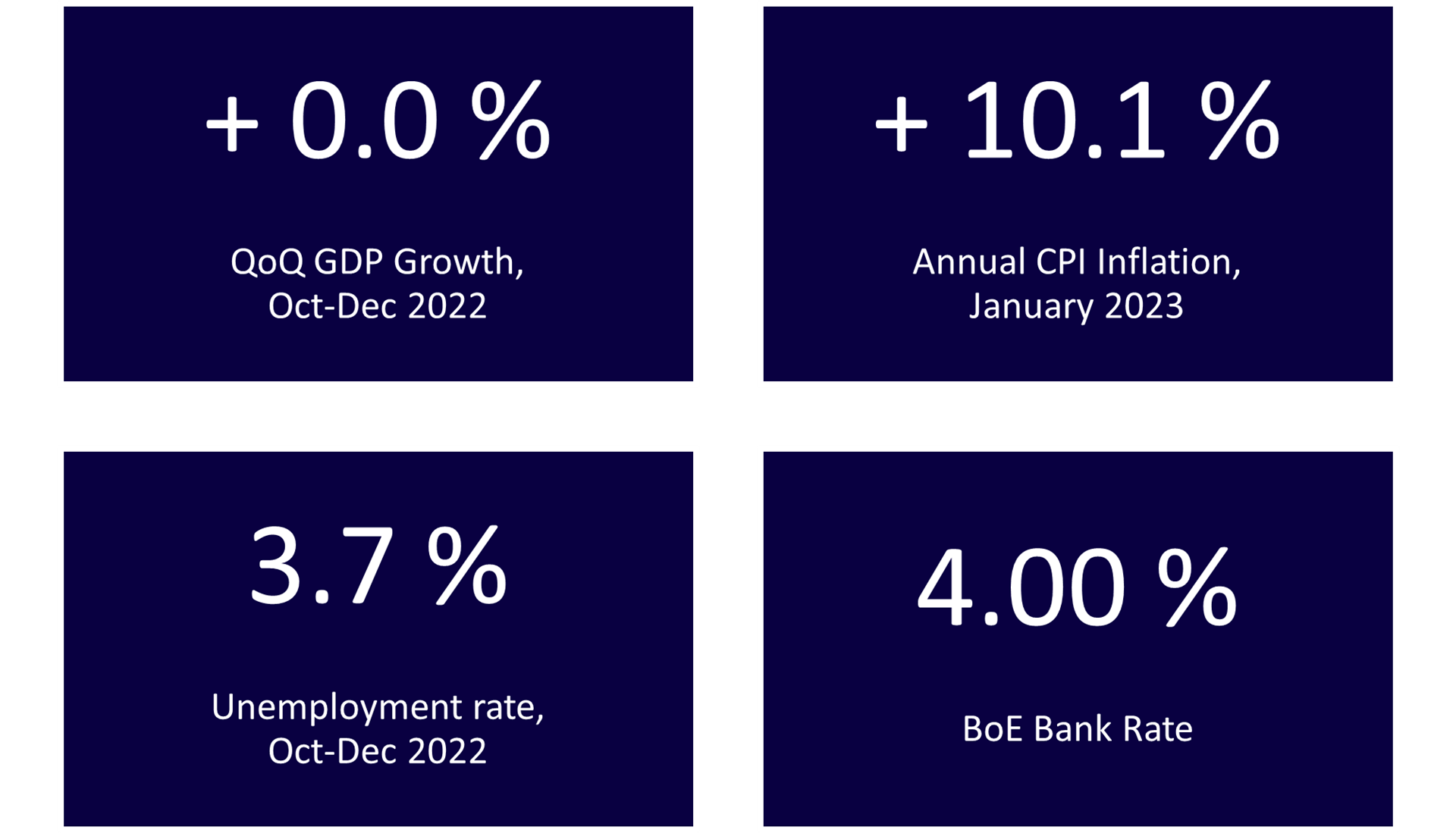

The UK narrowly avoided a recession in the final quarter of 2022 – the economy decreased in size by 0.2% in the third quarter of 2022 but remained the same size in the final quarter. This is better than expected by the Bank of England, who, in their November economic forecast, predicted the UK economy would shrink by 0.4% in the final quarter of 2022.

Prices fell 0.6% in January 2023 compared to December 2022, primarily because of falling motor fuel prices. Nevertheless, headline inflation remains at 10.1%, meaning prices in January 2023 were 10.1% higher than 12 months earlier.

The Bank of England continues to combat inflation by raising the Bank Rate to 4.0% to slow down the economy. Their efforts are beginning to have an effect, but inflation is not forecast to reach near the Bank of England’s target of 2% until the first quarter of 2024. The UK currently has the highest inflation rate in the G7.

The UK unemployment rate remains historically low at 3.7%. Despite economic concerns, unemployment is expected to rise by no more than 1.2 percentage points to 4.9% in the summer of 2024. The is due to the UK having had labour shortages/excess vacancies for the past two years. As a result, firms are likely to reduce the number of vacancies they are posting before laying off workers.